Across the country, home buyers and real estate investors have found it increasingly difficult to purchase or invest in real estate over the course of the past year. There has been a lack of inventory, therefore skyrocketing the prices. Buyers will run into the issue of not having a lot of options, having to compete with numerous offers, and having to place an offer well over the asking price. The United States has found itself in a housing bubble, and that bubble is set to pop very soon.

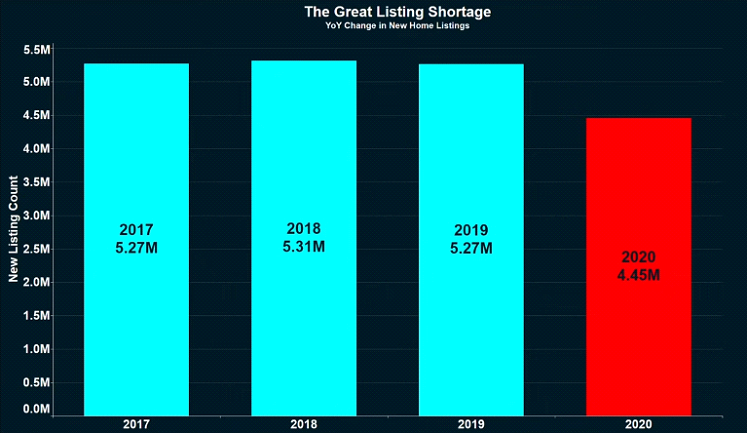

From 2017 through 2019, there was an average of 5.3 million active listings on the market at any given time. At the end of 2019, those listings began to plummet, and the United States reached 4.45 million active listings in 2020.

In March of 2021, the COVID-19 pandemic was in full effect. Nonessential businesses, like restaurants, movie theaters, and clothing stores, were closed, people were working from home, and you had to wear a mask if you left the house. This economical shut down contributed to the decline of active listings; people took their already active listings off the market, and those who had plans to list, delayed. Now, a year after peak hysteria from the COVID-19 pandemic, people are still delaying due to the frothy market. As of March 2021, there are 500,000 active listings on the market at any given time, and the price of each listing has averaged out to $375,000.

In March of 2021, the COVID-19 pandemic was in full effect. Nonessential businesses, like restaurants, movie theaters, and clothing stores, were closed, people were working from home, and you had to wear a mask if you left the house. This economical shut down contributed to the decline of active listings; people took their already active listings off the market, and those who had plans to list, delayed. Now, a year after peak hysteria from the COVID-19 pandemic, people are still delaying due to the frothy market. As of March 2021, there are 500,000 active listings on the market at any given time, and the price of each listing has averaged out to $375,000.

All those people who removed their house from the market or waited to post their listing, due to COVID-19, are still out there. Due to the lack of active listings, the incentive for people to list and sell their homes only gets greater as prices continue to rise. When that incentive gets to the right point, that backlog of people wanting to sell their homes are going to begin listing. There were 1.1 million fewer listings in 2021 than 2020 due to the pandemic, and 900,000 resale listings to get to the pre-COVID baseline of active listings; that’s 2 million active listings. Another source of active listings on the market are home building permits. Home builders are reaching the number of new housings permits that reflect the number of permits they hit in 2006/2007, right before the housing crash in 2008.

All those people who removed their house from the market or waited to post their listing, due to COVID-19, are still out there. Due to the lack of active listings, the incentive for people to list and sell their homes only gets greater as prices continue to rise. When that incentive gets to the right point, that backlog of people wanting to sell their homes are going to begin listing. There were 1.1 million fewer listings in 2021 than 2020 due to the pandemic, and 900,000 resale listings to get to the pre-COVID baseline of active listings; that’s 2 million active listings. Another source of active listings on the market are home building permits. Home builders are reaching the number of new housings permits that reflect the number of permits they hit in 2006/2007, right before the housing crash in 2008.

In total, there will be about 2.5 million listings entering the market. The market will be flooded with sellers, and the euphoria from the past 9 months will turn to hysteria, causing a crash.